How much will that four-legged pal cost you?

Q: How much does it really cost to have a dog?

A: That ball of fur may be adorable, but having a dog doesn’t come cheap!

Here’s a rundown of what buying and owning a dog can cost.

Beware of Gift Card Scams

Everyone loves a gift card for their favorite retailer or restaurant. It’s like getting money to spend in any way you please! Unfortunately, scammers also love gift cards, but for all the wrong reasons: They often use gift cards to pull off scams. Here’s what you need to know about gift card scams and how to avoid them.

Your Complete Guide to Secure Mobile Banking

In response to the rise of mobile banking scams, the Consumer Financial Protection Bureau (CFPB) recently published new guidance on unauthorized electronic funds transfers or EFTs. With more people using electronic banking as a holdover from pandemic times, it’s important for consumers to be aware of its vulnerabilities and how to protect themselves from scams. Here’s what you need to know about the risks of mobile banking and how to stay safe.

Did You Know that We Offer RV loans?

If you’re thinking of road-tripping your next getaway, think RVs. Recreational vehicles and their close cousin, campervans, are growing increasingly popular as more families hit the road for a true American adventure that’s easier on the wallet and heavy on the fun. When purchasing an RV, you can go all out with a fully loaded luxury vehicle, or go the less costly route by opting for a campervan, also called a Class B motorhome. The best part is that our current New and Used RV Loan rates are 5.99% APR both up to 180-month term (15 years)!

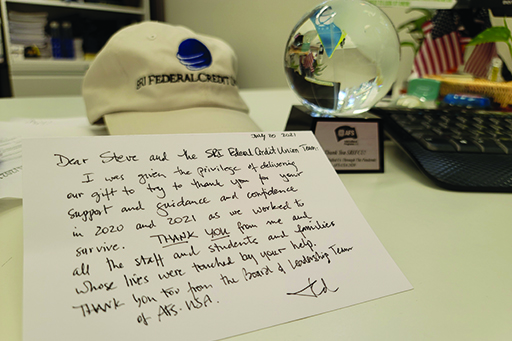

A Special Thanks From AFS-USA

As part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the U.S. Treasury, and Small Business Administration implemented the Paycheck Protection Program in 2020. This was an effort to assist small business owners whose business operations had been adversely impacted by the COVID-19 pandemic crisis through a short-term loan relief program.

Deciphering Financial Aid Award Letters

You’ve received your college acceptance letters – congratulations! If you’ve been accepted to multiple schools, one of the biggest determining factors for your final choice may be the out-of-pocket cost for each option. Along with your acceptance letters, you should receive an award letter outlining the financial aid for which you are eligible at each college.

64th Annual Meeting

SRI Federal Credit Union’s 64th Annual Meeting will be held virtually on Wednesday, March 17th at noon.

Digital wallets: What are they and how do they work

Seeing people pay with their cellphones or watches has become the new normal. The days of printing out your boarding pass before you check into your flight are now in the past. Digital wallets are a new way to stay organized and safe.

SRI FCU Virtual Annual Meeting 2020

SRI Federal Credit Union’s 63rd Annual Meeting will be held virtually on Wednesday, September 16th at noon.

We Are Here To Help

Amid ongoing concerns about the Coronavirus COVID-19, we want to reach out and share a few of the ways we are here to serve you during this time:

If you’ve been impacted by COVID-19 and need our support, we’re here to help. Send a message through online banking, contact us or call us at 1-800-9863669 to talk to one of our staff members for assistance. They will be happy to go over all your available options, such as Emergency loans, credit line increases, Special Student Loan Forbearance and Skip-A-Payments.

Contact Us

Call: 650.800.5434

Fax: 650.326.8916

333 Ravenswood Ave

Menlo Park, CA 94025-3493

Mailing Address:

P.O. Box 2284

Menlo Park, CA 94026-2284

Routing Number: 321173328

All deposits are insured by the NCUA to at least $250,000.