Financial Literacy

Why Summer 2025 Is a Smart Time to Buy a Car

Summer is one of the most popular and strategic times to purchase a vehicle. As dealerships gear up for new model releases in the fall, they’re motivated to move current inventory. That means hot deals and promotional pricing are heating up right alongside the weather. Whether you’re in the market for a new or used car, now is a great time to find a vehicle that fits your lifestyle and budget.

Important Updates to Funds Availability and Check Collection Rules

To ensure continued compliance with federal banking regulations, SRI Federal Credit Union would like to inform our members of upcoming changes to Regulation CC, the rule that governs the availability of funds and the collection of checks. These changes, mandated by the Federal Reserve Board and the Consumer Financial Protection Bureau (CFPB), effective as of July 1, 2025.

Honoring Legacy, Empowering Futures: The 2025 SRI Federal Credit Union Memorial Scholarship

At SRI Federal Credit Union, we’re proud to support education and honor the legacy of those who helped build our credit union community. That’s why we’re excited to announce the 2025 SRI Federal Credit Union Memorial Scholarship — an opportunity for promising students to receive financial support as they take their next big step in life.

How Tariffs Impact the U.S. Market and Why Credit Union Membership Provides Stability

Tariffs have long been a tool used in global trade to influence economic policies, protect domestic industries, and sometimes serve as leverage in international negotiations. However, they can also create volatility in financial markets, affecting everything from stock prices to consumer goods costs. With the ongoing uncertainty surrounding tariffs and their impact on the U.S. economy, having your money in a stable, member-focused institution like SRI Federal Credit Union is more important than ever.

SRI Federal Credit Union: Built to Last, Secured for You

There has been some recent confusion regarding DOGE and the use of the word “Federal” in “SRI Federal Credit Union.” We want to take this opportunity to clarify key facts and reassure our valued members that their financial security remains our top priority.

Kickstart Your Financial Goals for 2025 with SRI Federal Credit Union

The start of a new year is the perfect time to reflect, set goals, and take charge of your finances. At SRI Federal Credit Union, we’re here to help you achieve those goals with products and services designed to make your money work harder for you. Whether you’re saving for a big purchase, paying off debt, or building financial stability, we’ve got you covered.

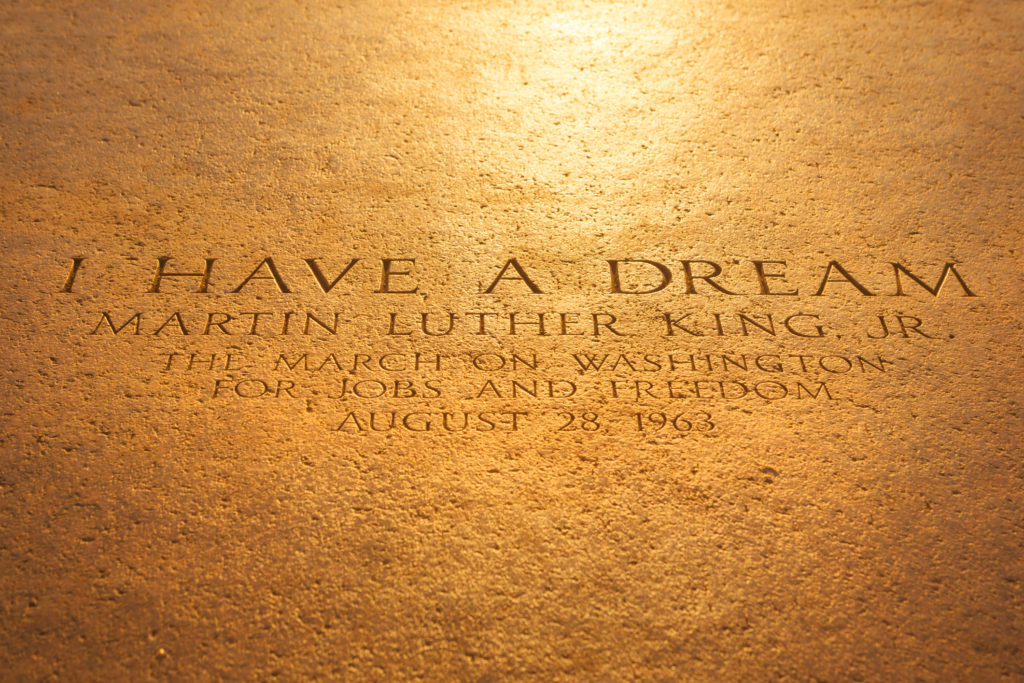

Honoring Martin Luther King Jr.: Financial Empowerment and the Credit Union Movement

As we honor the legacy of Dr. Martin Luther King Jr. this month, we’re reminded of his unwavering commitment to justice, equality, and the empowerment of communities. While Dr. King is most renowned for his leadership in the civil rights movement, his vision extended beyond social equality to include economic empowerment—a principle that aligns closely with the mission of credit unions like SRI Federal Credit Union.

New Year, New Financial Goals: Start 2025 with Confidence

As we step into 2025, it’s the perfect time to set new financial goals and take control of your future. At SRI Federal Credit Union, we’re here to support you every step of the way with products and services designed to help you save, grow, and manage your finances more effectively. Whether you’re looking to build a stronger savings habit, make home improvements, or lower your auto loan payments, we’ve got you covered!

Give Yourself the Gift of Financial Flexibility This Holiday Season with Skip-A-Pay!

The holiday season is here—a time for joy, celebration, and giving. But with festive gatherings, gift shopping, and travel plans, the expenses can quickly pile up. At SRI Federal Credit Union, we want to make your holidays a little brighter by giving you the option to free up extra cash when you need it most with our Skip-A-Pay Program!

Buying a Car in December 2024: Why Financing with SRI Federal Credit Union is the Smart Move

December is one of the best months to purchase a car. Dealerships are eager to hit their year-end sales quotas, which means you can take advantage of deep discounts and special promotions. Whether you’re buying a used or new vehicle, this is the perfect time to find great deals. However, securing the right financing is just as important as finding the right car. That’s where SRI Federal Credit Union comes in.