Unfortunately, scammers know this, and they’re taking advantage.

At SRI Federal Credit Union, we want to help you understand how these scams work and what you can do to protect yourself.

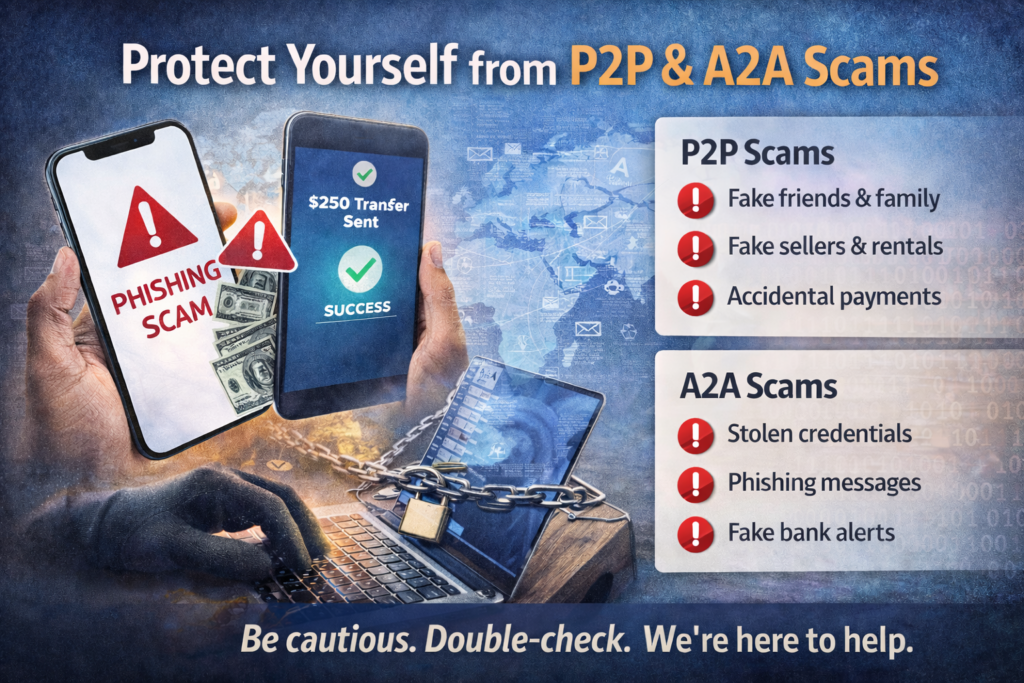

What Is P2P Fraud?

P2P fraud happens when someone tricks you into sending them money directly. Because these payments are quick and usually final, it can be hard to get funds back once they’re sent.

Common P2P scams include:

-

Someone pretending to be a friend or family member asking for money urgently

-

Fake sellers or rentals that disappear after payment

-

“Accidental payment” scams, where someone asks you to send money back

-

Fake tech or banking support asking you to “verify” your account with a payment

If the request feels rushed or unusual, that’s a big red flag.

What Is A2A Fraud?

A2A fraud involves unauthorized transfers between bank accounts. These scams often start with stolen login information or convincing messages that look legitimate.

Common A2A scams include:

-

Phishing emails or texts that steal your online banking login

-

Fake invoices or payment requests

-

Scammers posing as employers, vendors, or financial institutions

-

Account takeovers after credentials are compromised

Why Scammers Are Successful

Most scams rely on pressure and emotion. Fraudsters often:

-

Create urgency (“Act now!”)

-

Pretend to be someone you trust

-

Use fear or authority to rush you into action

Taking a moment to pause and double-check can stop a scam in its tracks.

How You Can Protect Yourself

Quick safety tips:

-

Only send money to people you know and trust

-

Never share passwords or one-time passcodes

-

Be cautious with urgent payment requests

-

Double-check unexpected messages, even if they look familiar

-

Review your account activity regularly

Think You’ve Been Targeted?

Act fast:

-

Contact SRI Federal Credit Union right away

-

Stop any pending transactions if possible

-

Change your passwords

-

Report the scam so we can help protect others

We’ve Got Your Back

Scammers are always changing tactics, but staying informed makes a big difference. If something feels off, trust your instincts and reach out. We’re here to help keep your money safe.